Calculate your Zakat on Savings through Transparent Hands Calculator

Introduction

Muslims who suck at Math, gather around! We have got something important to share with you about your zakat calculations. Yes, we know you are having trouble calculating the exact figure and it is nightmarish for some of you! Don’t get us wrong, we totally get you! Calculating zakat on all of your assets in one sitting is simply not possible without ending up with a headache. Muslim scholars often make a light-hearted comment about the fact that the more wealth you have, the more complicated your zakat calculations will become, so live a simple life. But in some cases, things get so messed up that one feels like banging head in the wall. We don’t want you to be breaking your skull, which is why we invite you to read this discussion till the very end. In this brief, our focus will be on calculating zakat on savings, a FAQ that needs a comprehensive answer!

Donate for Upcoming Medical Camps

What is the ideal time to pay zakat?

All twelve Islamic months! Some of you are a little startled, but it is what it is. Contrary to the popular belief, no-obligation states zakat can be paid in Ramadan only. Dispelling that notion from Muslim society is important because the wealth remains locked up in the vaults of rich ones during the other eleven months. This practice defies the principle aim of zakat i.e. elimination of financial stagnancy from society. We strongly encourage you to pay your zakat a little early this year, post-Ramadan. There are millions out there who still need our help post the first two waves of the COVID-19 pandemic. Your zakat donation can impact the lives of those who seek a ray of hope from any corner! In fact, the ideal time to pay zakat is NOW!

How to calculate zakat on your savings?

It creates a lot of confusion if your savings dip below the Nisab threshold for a certain time. Do you or do you not pay zakat? Well, you are exempt from paying zakat during the aforementioned period. However, you are due zakat again once you hit the Nisab threshold and a year has passed on your accumulated wealth. Query solved? Oh wait, you have a few more! Do you need to pay zakat on profits? The answer to this question is in the affirmative. Zakat must be paid on whatever amount you have in your account. It is worth mentioning here that zakat cannot be paid to direct family members e.g. parents/grandparents/children. Do you have to pay zakat on interest? Absolutely not, and may we add, interest is already considered as impure money in Islam. The concept of zakat counters the very idea of interest, there is a direct clash between the two systems.

How zakat calculators are making life easy?

Calculating zakat can be quite a challenge, especially if your asset list is a long one. May we suggest a solution that can save you from a lot of anxiety and save your time as well? Online zakat calculators! Of course, you cannot trust all of these calculators, but the ones you can get the job done for you in a matter of minutes. All that you have to do is enter the values rightly in the designated columns and then press hit on the calculate button. A number will appear on your screen, which is the zakat you are due for that particular year! How simple but clever at the same time?

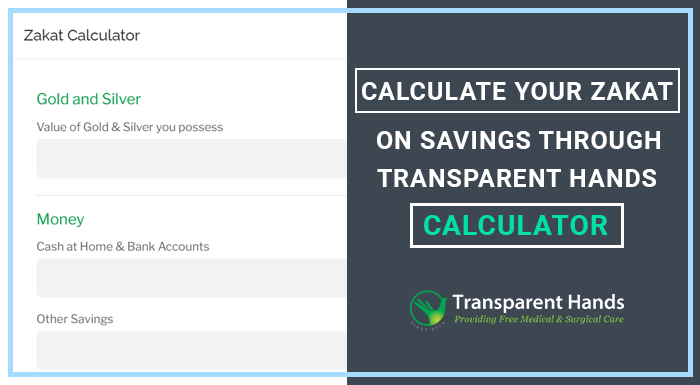

Calculate zakat via Transparent Hands zakat calculator!

There are many zakat calculators available online, but the question is: Can you trust all of these? And the answer is no, you can’t use a random zakat calculator. Reason? Some of these zakat calculators are not regularly updated, the conversion rates are from the years gone by. This can lead to miscalculated figures. Don’t want to be messing up this religious financial obligation, do we? If you are not in the mood of searching for a reliable zakat calculator, we have something that can save you valuable time. Opt for the Transparent Hands zakat calculator! A simple interface, easy to use, super-fast and reliable, this tool will get the job done for you every year!

How to use it? On the main page of the calculator, you will see several empty columns against the title of the asset. All that you have to do is enter the data in the right column. For example, if you want to calculate your due zakat on cash, please enter the amount in the “Money” row, and then press calculate.

Calculating online? How about donating online?

When you calculate your zakat via the Transparent Hands zakat calculator, you will notice a little button that says “Pay Zakat”. Again, if you don’t want to look up charities in your neighborhood, we have a solution that can save a lot of your precious time. Online donations! And one organization that deserves every penny of your zakat money is Transparent Hands!

Transparent Hands is the largest technological platform for crowdfunding in the healthcare sector of Pakistan. Pakistan’s healthcare system needs all the help it can get from NGOs and INGOs, exactly what Transparent Hands has been doing for a decade now. It offers a complete range of free healthcare services including medical and surgical treatments, medical camps, and telehealth facilities to the underprivileged community of Pakistan. The platform provides visibility to underprivileged patients and builds a personal and trusted bond between patients and donors while ensuring complete transparency. It also sets up free medical camps in the rural areas of Pakistan in which, free medical consultation, free medicines, and free diagnostic tests are provided to deserving patients. Donors from all over the world can use the Transparent Hands crowdfunding web portal and donate through 100% secure payment modes. They could select any patient, fund the treatment and receive regular feedback and updates until the patient has recovered completely. Well, if that resume sounded perfect to you, maybe you already know where your zakat donation is going this year!

Leave Your Comments