Maximum Tax Rebate on Charitable Donations in USA

Taxpayers are now concerned about the Tax Cuts & Jobs Act law which has brought significant changes regarding charitable deductions. The standard deduction scale has gone higher this year which means most itemizers won’t benefit from it. If you are still willing to itemize the lower tax brackets that may lessen your deduction making it less valuable. Again some concealed elements which are often overlooked by the taxpayers in the tax law will increase the value of charitable deductions for a specific group of people.

Maximum Tax Rebate on Charitable Donations in USA

1 – Pease Deduction Limitations:

2 – Donating Appreciated Stocks:

3 – The Economic Bubble Range:

4 – Creating a Donor Advised Fund (DAF):

- Pease Deduction Limitations:

The significant changes in Pease limitation mean taxpayers can claim a greater deduction for greater giving.

In 2017, the Pease deductions were reduced by 3% of income surpassing the $261,500 amount for single individuals. For example, suppose an individual donor had $1,500,000income and deducted only $50,000 in charitable donations.

In 2017 the Pease Reduction calculation would work in the following way:

[($1,500,000 income – $261,500 threshold) x 3%]=37,155.

This Pease reduction calculation would have allowed him to deduct $37,155 from his $50,000 gift into the tax statement making him adjust up to $12,845 on his financial benefits.

The deduction for the same $50,000 gift in 2018 would be the entire amount donated. The sudden rise from a $12,845 deduction to a $50,000 deduction for the same donation can make a big difference for the wealthy donors.

- Donating Appreciated Stocks:

Donate appreciated assets like stock, bonds or precious metals to charitable organizations. Donating such assets will reap double benefits for you. You will be free from paying any Capital Gains Tax (CGT) and be able to deduct the fair market value of the property at the same time.

Maximum Tax relief on charitable donation in USA

Appreciated assets donated to a charity are no less than a checkmate. This is a big success for both the parties. The donor will be giving a larger chunk from his bucket to the charity and in return will enjoy zero tax rates on his property.

- The Economic Bubble Range:

Lowering the income tax brackets this year will make charitable deductions less useful. In 2017, the to most federal tax rate was 39.7%, so a taxpayer who had paid $100 cash donation could receive a federal tax benefit of $39.70. However, the tax reformation law in 2018 has reduced the tax bracket to 37%, so the same $100 will now receive a tax benefit of $37.00.

Fortunately, the same tax reformation law has increased the tax bracket for some people. Single Tax filers earning $200,000 to $416,700 was in the 33% tax rate but now individuals earning between this ranges will receive a 35% reduction rate. This particular group in the economic “bubble,” will benefit from the new law as their value of charitable tax deduction has increased.

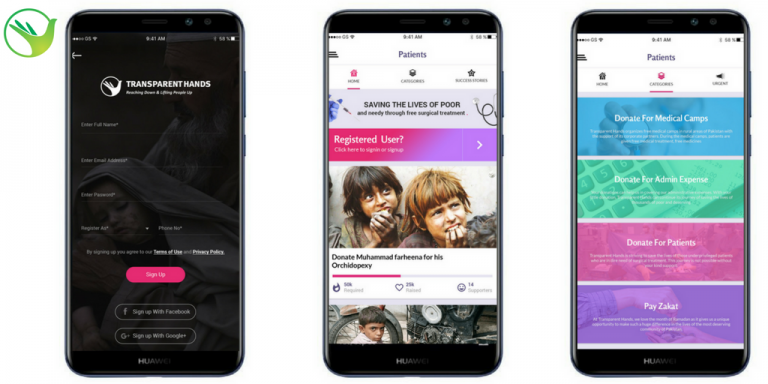

Download our TransparentHands Andriod Application for Online Donation

- Creating a Donor Advised Fund (DAF):

The increasing popularity of the donor-advised fund is attracting Americans to make a smart and efficient charitable giving.

When you donate to donor-advised funds the charity immediately gives you the maximum tax deduction allowed by the IRS. You can name your donor-advised fund account and authorized advisors, any successors or charitable beneficiaries if you want. Your assets will be invested into a donor-advised fund account where it will grow tax-free.

If you were eligible for estate taxes your DAF will incur no tax under this category. Your DAF will also reduce the AMT amount if you were eligible for the Alternative Minimum Tax (AMT).If you donate cash to DAF you will receive deduction up to 60 % of your AGI. If you donate appreciated assets or securities you will receive deductions up to 30 % of your AGI.

Bottom Line:

The amount of maximum tax rebate on charitable deductions this year will largely depend on each individual’s income. For some taxpayers, the deduction value will go up whereas for others it will go down. The new tax law will seem complicated to many because deductions have gone up only for the people who have high yearly income and posses a large wealth but such taxpayers are only fewer in numbers.

Higher standard deductions and lower tax rates mean more disposable income for the wealthy taxpayers which will lead to more opportunities for donations. The new tax law may have the impression of everything falling apart for some taxpayers as they will find it quite hard to strike a right balance between their family income and budget management but to others, it may shower with immense opportunities. Therefore, the tax reformation law is a mixed bag of good and bad for taxpayers in the country.

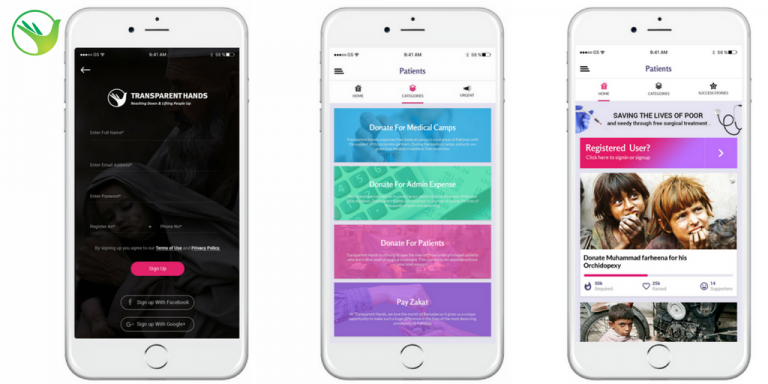

Download our TransparentHands iPhone Application for Online Donation

Leave Your Comments